That night's musical roster was a part of team BOTB-Tevin Campbell, Andrae Crouch, Sandra Crouch, Kool Moe Dee, Big Daddy Kane, Melle Mel, Siedah Garrett, Al Jarreau, and Take 6 - presented hip-hop alongside gospel, conscious rap beside jazz fusion. (40 to 45 words)

February 10 1990

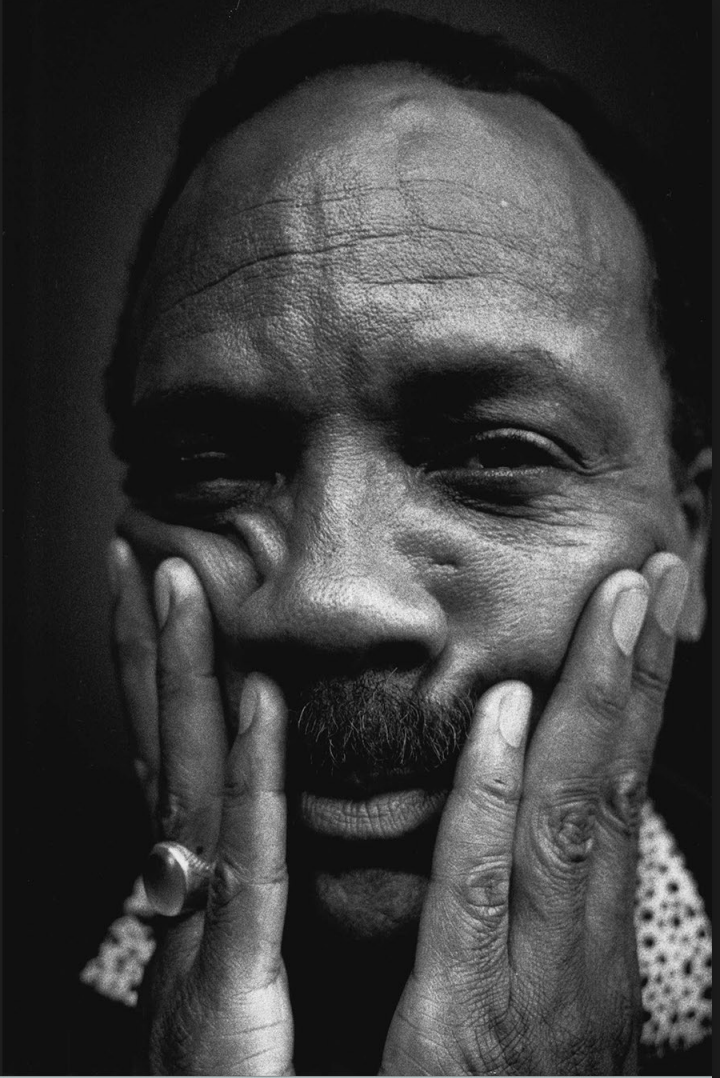

QUINCY JONES TRANSFORMED saturday night live into cultural crossroads

As Jones delivered his opening monologue, he carried electri- fying news: Nelson Mandela was hours away from freedom after twenty-seven years of imprisonment. Timed near the re- lease of Jones' collaborative masterpiece, 1989's Back On the

And when the SNL Band (which had swollen to orchestral size) performed Dizzy Gillespie's epic "Manteca" under Jones' baton, here was the once controversial bebop conducted by a man who had not only worked alongside Gillespie during the integration battles of the 1950s.

Jones' embrace of the then-controversial hip-hop was a warm hug and leg-up from a beloved big bro. In 1990, rap still fought for legitimacy on mainstream platforms like SNL, one of Ameri- ca's main cultural gatekeepers in the pre-internet era. By fea- turing Kane, Moe Dee, and Melle Mel, Jones, then 60. gave a stamp of respect and approval to rap. Back then it often func- tioned as a new chapter in Black music's tradition of using rhythm and poetry to speak truth to power.

"HERE'S A TITLE SONG FROM MY NEW ALBUM, BACK ON THE BLOCK. MY SON QD3 WILL TELL YOU WHAT'S UP."

- QUINCY JONES ON SATURDAY NIGHT LIVE

The SNL night was full of its usual shenanigans (in a sketch, Jones even drove a "Miss Daisy"), but in those tense hours be- tween Mandela's captivity and freedom, Jones created a sonic portrait of America at a crossroads, where the long arc of artis- tic evolution bent toward liberation itself.

Month 1993

QUINCY JONES PUTSHIS STAMP ONHIP HOP

The year of VIBE's official launch. Jones' definitive hip-hop culture publication is a journalistic platform for serious cover- age.

The year of VIBE's official launch. Jones' definitive hip-hop culture publication is a journalistic platform for serious cover- age.

With regard to music: De La Soul samples Jones' work in "Breakadawn," and Björk's "Human Behavior" also samples a Jones composition.